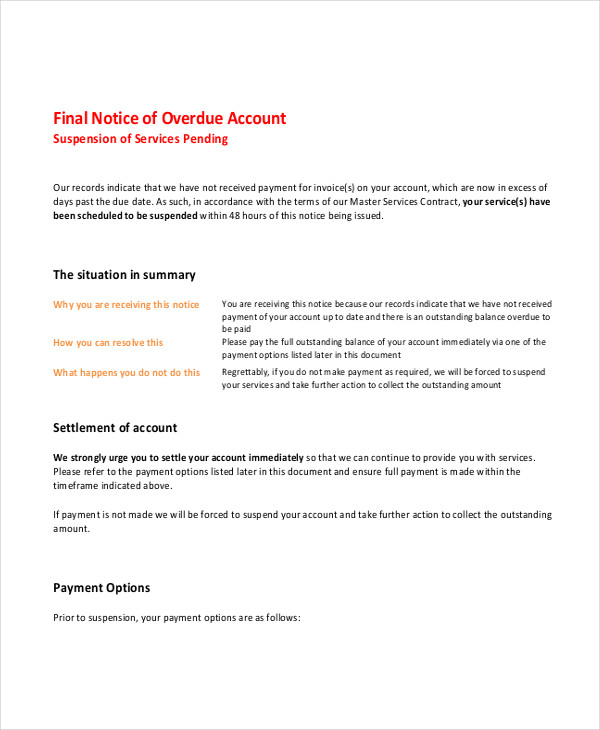

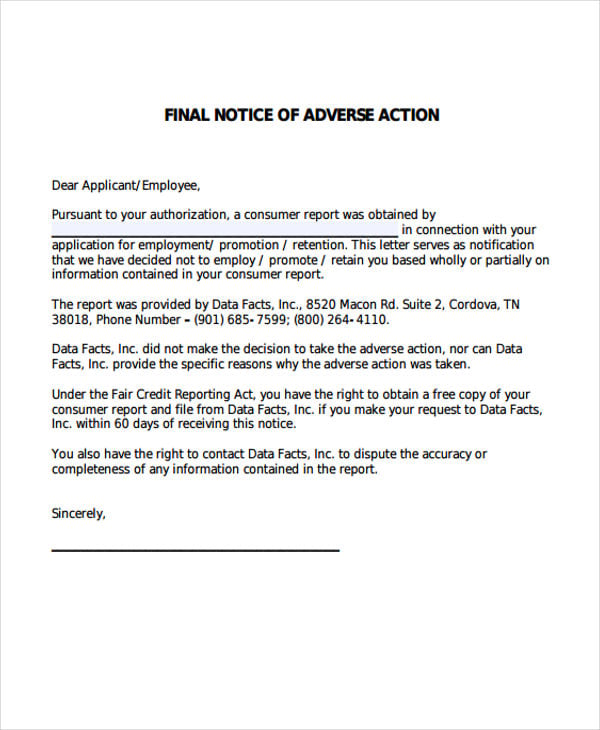

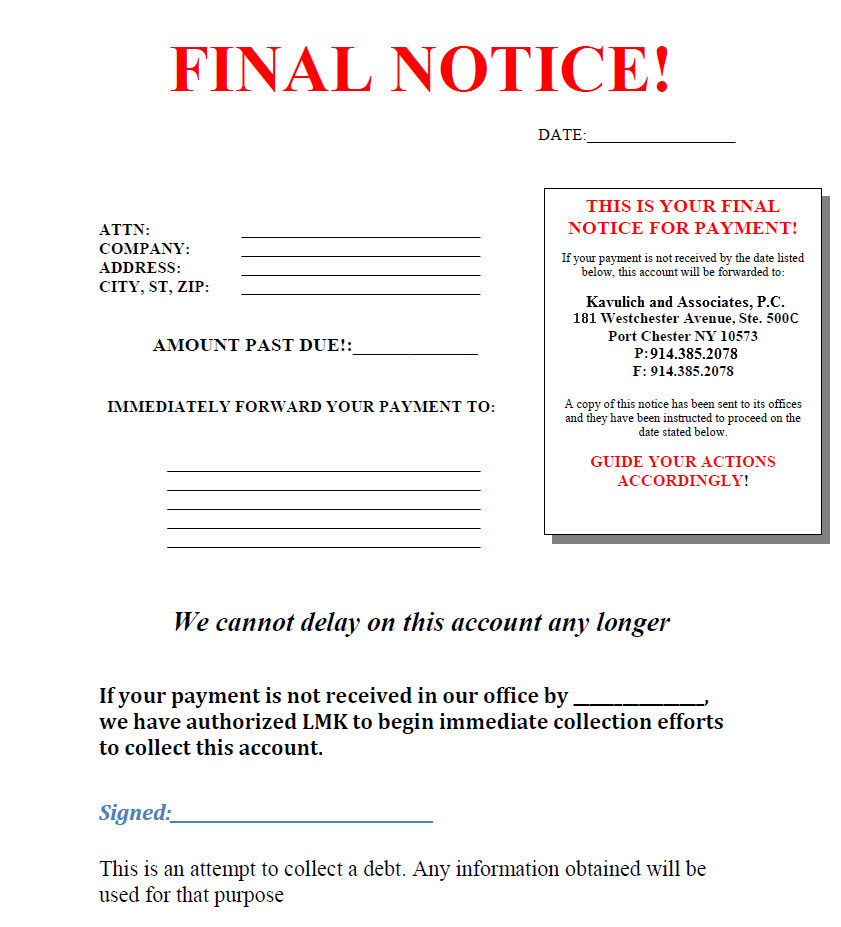

For many people, they simply don’t know what to do first and how to sort out the default.Ī default notice ( sometimes referred to as a default letter or Notice of Default) is a formal letter sent to you by a creditor as a result of payments missed on a credit agreement between yourself and a credit provider. This can be both surprising and stressful in equal measures. Normally the first you hear about a default is when a default notice lands on your doormat.

You'll get full access to the UK's most detailed Credit Report, with information from all four Credit Reference Agencies, not just one. If you haven't already, you can try checkmyfile free for 30 days, then for £14.99 a month afterwards, which you can cancel at any time. To find out more information about a default, your Credit Report is likely to hold the answers you're looking for, including lender details, how much is allegedly owed and payment history for that account. But if it happens to you, there’s still plenty to do to make sure you stay in control. Sometimes it really is out of our control that we miss payments on a credit agreement and end up with a defaulted account.

Whatever the reason, in times of hardship financial commitments are often among the first things to be affected.Īccording to Finder, a third of UK homes have less than £600 in savings, so it really doesn’t take long to feel the pinch from a financial setback.

Perhaps your household income dropped due to redundancy, you’ve suffered an illness, or an unexpected large expenditure has cropped up. No one wants a default on their Credit Report, but sometimes there’s little you can do to prevent it.

0 kommentar(er)

0 kommentar(er)